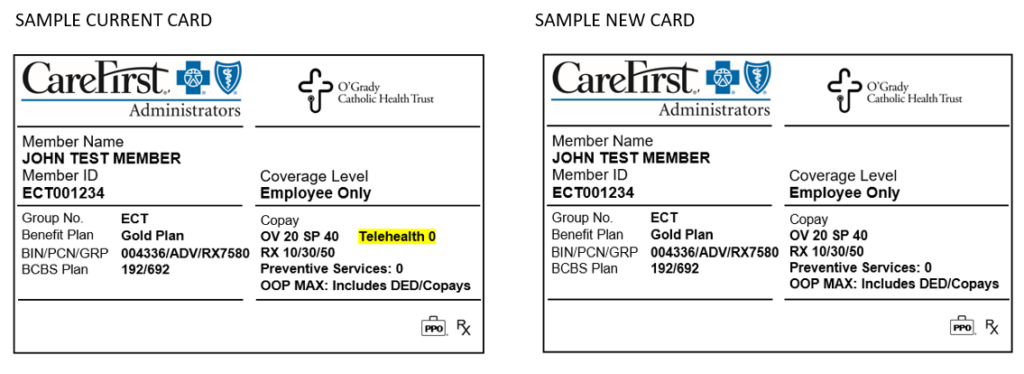

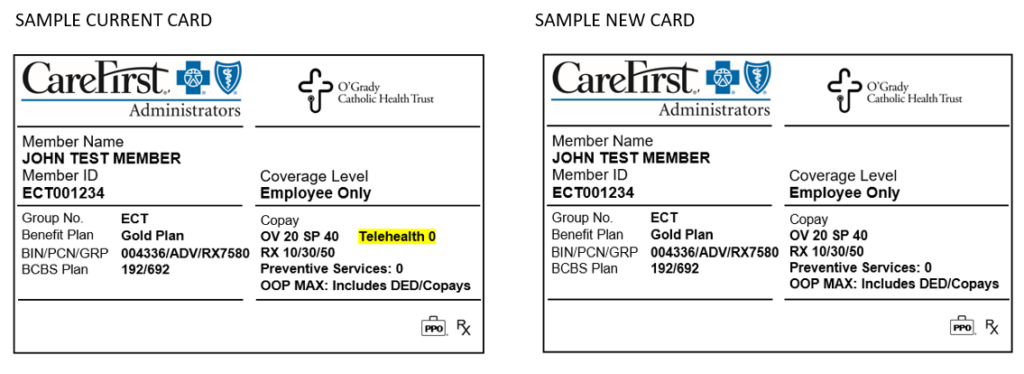

Will I receive a new medical ID card after open enrollment (for the 2021 plan year)?

Yes. CareFirst Administrators will send you a new ID card for your 2021 medical plan, even if you do not change medical plans. This will come in a plain white envelope. Be sure your mailing address is up to date with your employer to prevent delays in obtaining your new card.

The reason for this decision, is due to confusion that could arise due to the current card showing “Telehealth 0.” The new card removes this piece of information because of the varying telehealth benefit as outlined below.

For MDLIVE Providers:

MDLIVE telehealth visits have the $0 copay for Platinum, Gold, & Silver plans, or Deductible then $0 copay for the Bronze plan.

- During the national health emergency (through 12/31/2020) the deductible is waived for the Bronze plan for MDLIVE visits.

For Non-MDLIVE Providers:

The standard office visit benefit applies for virtual or telephonic visits with providers for clinical staff of primary care, general practice, internal medicine, pediatrics, OBGYN and associated nurse practitioners only, during the national health emergency, through 12/31/2020. Starting 1/1/2021 the plan will cover virtual and telephonic visits with all non-MDLIVE providers at the applicable office visit benefit (including specialists).