Employees & Families / Frequently Asked Questions

Did you know we promote community resources?

Conifer Health’s goal is to help you find the best care possible within the options offered through your employer’s health plan. In addition, your personal health nurse will advocate for your health needs by working with you and your family members to identify community resources to further support your goals for healthy living.

Why should I trust Conifer Health?

Conifer Health serves many thousands of health plan members through its unique and holistic approach to personal health management. Throughout the personal health management program, your medical information is handled in a confidential and professional manner and will not be shared with your employer or anyone else without your consent. Our clinical team comprises full-time nurses who are credentialed and certified through state laws and professional groups, and our clinical guidelines are regularly reviewed by nationally-recognized practicing physicians. In addition, the Conifer Health Personal Health Management operation is accredited by a national quality organization.

How does the Personal Health Management program work?

An experienced nurse employed by Conifer Health reviews your health information and determines if you, or a dependent, could benefit from Personal Health Management support. If you qualify for the program, a nurse will call you to provide you with key information about the program and to discuss

your healthcare needs. If you choose to enroll in the program, the nurse becomes your personal health nurse and serves as your healthcare advocate — helping you live a healthier life through personalized, convenient support. Additionally, if you feel that you qualify for the Personal Health Management program, you may contact your personal health nurse directly.

Can Personal Health Management support make a difference in my life?

Personal Health Management through Conifer Health, is a free, confidential program that empowers you to become informed and proactive about leading a healthier life. Whether you are chronically ill, suffering from complex medical conditions or experiencing an acute illness, navigating the evolving healthcare system can be challenging. The Personal Health Management program offers one-on-one support by collaborating with you and your healthcare providers to develop your customized care plan. Our goal is to provide the peace of mind you need to start focusing on the right things, like improving and maintaining your health.

Does our plan offer gym membership discounts or other wellness discounts?

If you are enrolled in the Trust medical plan, you are Blue Cross and Blue Shield (BCBS) member. As a BCBS member, this gives you exclusive access to healthy deals and discounts through Blue365. With Blue365, great deals are yours for every aspect of your life – like discounts on brand name sneakers, heart rate monitors, and gym memberships! Register now at www.blue365deals.com to take advantage of Blue365. Just have your Blue Cross and Blue Shield member ID card handy. In a couple of minutes, you will be registered and ready to shop.

How do I register on Caremark.com?

Use this guide to walk you through the process of registering online for member access to Caremark.com.

Where can I easily shop for FSA Eligible expenses?

P&A’s vendor partner, FSA Store, offers discounted pre-approved eligible expenses including PPE, COVID-19 at home tests, over-the-counter medications and more. Browse FSA Store today.

How much does a telehealth visit cost?

For MDLIVE Providers:

MDLIVE telehealth visits have a $0 copay for Platinum, Gold, & Silver plans, or Deductible then $0 copay for the Bronze plan. During the national health emergency (through 12/31/2020) the deductible is waived for the Bronze plan for MDLIVE visits.

For Non-MDLIVE Providers:

The standard office visit benefit applies for virtual or telephonic visits with providers for clinical staff of primary care, general practice, internal medicine, pediatrics, OBGYN and associated nurse practitioners only, during the national health emergency, through 12/31/2020. Starting 1/1/2021 the plan will cover virtual and telephonic visits with all non-MDLIVE providers at the applicable office visit benefit (including specialists).

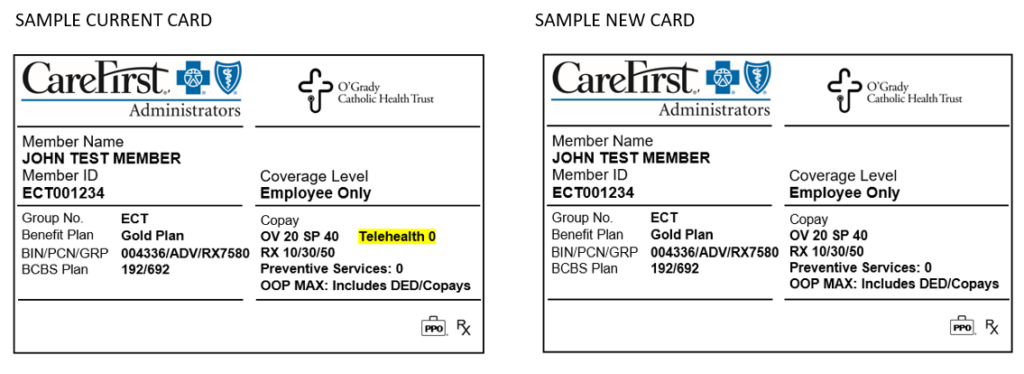

Will I receive a new medical ID card after open enrollment (for the 2021 plan year)?

Yes. CareFirst Administrators will send you a new ID card for your 2021 medical plan, even if you do not change medical plans. This will come in a plain white envelope. Be sure your mailing address is up to date with your employer to prevent delays in obtaining your new card.

The reason for this decision, is due to confusion that could arise due to the current card showing “Telehealth 0.” The new card removes this piece of information because of the varying telehealth benefit as outlined below.

For MDLIVE Providers:

MDLIVE telehealth visits have the $0 copay for Platinum, Gold, & Silver plans, or Deductible then $0 copay for the Bronze plan.

- During the national health emergency (through 12/31/2020) the deductible is waived for the Bronze plan for MDLIVE visits.

For Non-MDLIVE Providers:

The standard office visit benefit applies for virtual or telephonic visits with providers for clinical staff of primary care, general practice, internal medicine, pediatrics, OBGYN and associated nurse practitioners only, during the national health emergency, through 12/31/2020. Starting 1/1/2021 the plan will cover virtual and telephonic visits with all non-MDLIVE providers at the applicable office visit benefit (including specialists).

How do I get up-to-date account information for my P&A account(s)?

Access your account balance and other information anytime, anywhere with P&A’s text message feature. Simply update your P&A account profile with your mobile number. Text “BAL” to the number 70626 and receive a text message with your account balance. You can also text “CLM” to the number 70626 to receive the status of your claims.

You can also log in to your P&A account to access your real-time account information or call the P&A customer service department at (800) 688-2611 for your latest account information. This system is available in English and Spanish.

How do I receive my reimbursement money?

The quickest way to receive your money is by direct deposit to your personal checking or savings account. You can sign up online by logging into your secure P&A Group account at www.padmin.com. If this is your first time logging in, or if you are unsure how to log in, please reference P&A’s “how to login instructions” or click here. Once you’re logged into your account, click Direct Deposit under Quick Links. Choose your account type, enter your bank account information and click Submit. Please allow up to five business days to setup your direct deposit. If you need to change your direct deposit information, you may do so by following the same steps above. Once enrolled in a direct deposit, all deposits are made via direct deposit until P&A is otherwise notified. You can also receive your money via a check mailed to your home.

What is the Use-or-Lose Rule?

Under this IRS guideline you must use your full election amount by the end of the plan year. Any remaining balance in your account will be forfeited. However, the IRS has relaxed this rule. Your employer has the option to adopt a provision that will allow up to $500 in Health FSA funds to be carried forward to the next plan year.

We encourage participants to plan carefully how much money they put into their account. Be conservative when selecting your annual election amount. Only calculate expenses you anticipate incurring. This can include expenses such as co-payments for prescriptions, vision expenses, and dental work. For help calculating your expenses check out this FSA Calculator here.

What is the Uniform Coverage Rule?

This rule applies only to the Medical Expense Reimbursement Account (Health FSA). The uniform coverage rule states that your full election amount is available to you on the first day of your plan year. What exactly does this mean? This means you have access to ALL of your funds right away! The uniform coverage rule allows your Health FSA to work like a line of credit. Expenses can be covered upfront, making it easier to budget your finances, especially during tougher economic times.

When can I change my FSA election?

Participants are only allowed to enroll in an account once a year, which is also known as the open enrollment period. During this time you decide how much money you wish to put in your account. Please note that participants cannot change their annual election amount after open enrollment unless they experience a qualifying event, which includes the following:

- a change in legal status (e.g., marriage, death of spouse, divorce, legal separation or annulment);

- a change in the number of dependents due to events such as birth or adoption;

- a termination or commencement of employment of a spouse or dependent; and,

- a change in the cost of dependent care expenses.

The annual election amount will be evenly divided over the course of a Plan year before taxes are withheld, thus increasing employees’ take-home pay.

How do I file a claim?

- Use your Benefits Card as a debit card purchase wherever MasterCard® is accepted. The money is automatically transferred from your Health FSA account to the merchant.

- QuikClaim Mobile Feature- Submit a claim and supporting documentation of your eligible expense directly from your smartphone! Go to www.padmin.com on your smartphone and log into your account.

- Online Claim Upload- After making a purchase, log in to your My Benefits account and fill out the online reimbursement form.

- Fax- submit a claim form via toll-free fax to (877) 855-7105.

- Mail- mail a claim form to P&A Group, 17 Court Street Suite 500, Buffalo, NY 14202.

When submitting a claim you must include a receipt/proof of purchase or insurance statement. To receive reimbursement faster, sign up for direct deposit to have your money directly deposited into your designated checking or savings account.

Who should I contact with questions about my FSA claim or the substantiation requirements?

Reach out to our Participant Services team at 1-866-451-3399. They’re available Monday through Friday, from 6 a.m. to 9 p.m. central time, with the exception of some major holidays. You can also email customerservice@discoverybenefits.com.

How do I submit FSA documentation?

The easiest ways to upload documentation are by logging in to your account at www.discoverybenefits.com or by using the free Discovery Benefits mobile app. If you choose to fax your documentation, please just be sure to include the receipt reminder for smooth processing.

If I used my FSA debit card at a hospital or dental office, shouldn’t my claim be automatically approved?

Unfortunately, not all expenses from a hospital or dental office are FSA-eligible. For example, some hospital gift stores sell flowers that could still be coded as “hospital” expenses, and some dental offices provide elective services like teeth whitening that could still be coded as “dental” expenses. Unfortunately, these are not FSA-eligible. By obtaining supporting documentation, we’re able to verify the eligibility of the expense to maintain compliance with IRS regulations.

What type of detail needs to be included in my FSA claim documentation?

The IRS requires that participants provide:

1. Date service was received or purchase made

2. Description of service or item purchased

3. Dollar amount (after insurance, if applicable)

4. Name of merchant/provider

How will I know if I need to substantiate a claim?

If Discovery Benefits doesn’t receive enough detail from the provider when you use your benefits debit card, you’ll receive a request for an itemized receipt.

Why do I have to substantiate FSA claims?

The IRS requires participants to provide documentation to make sure the expenses are FSA eligible.

How is testing and treatment of COVID-19 covered by my medical plan?

At the outset of the pandemic, the Trust elected to waive member cost share for treatment related to COVID. As average daily COVID-19 cases and hospitalizations continue to drop amid widespread vaccine adoption, we’re at an important turning point for our country and community. CareFirst Administrators has revisited with the Trust some of the benefits we enacted at the height of the pandemic.

Effective September 1, 2021, the Trust is ending member cost share waivers for COVID-19 treatment. Providers may collect the appropriate member cost share (copay, coinsurance, and deductible) for treatment rendered on and after September 1, 2021.

In keeping with local and federal requirements, the cost share waiver (that means no cost to members) will continue for the duration of the public health emergency (through May 11, 2023):

- Visits (in all settings) associated with diagnostic COVID-19 testing

- Diagnostic COVID-19 tests

- FDA-authorized COVID-19 antibody tests

Beginning May 12, 2023 member cost share for these services will be applied.

The COVID-19 vaccination is not considered preventive treatment and will remain at zero cost share for members.

Is MDLIVE safe and private?

Yes, MDLIVE is safe and private. MDLIVE is compliant with HIPAA (Health Insurance Portability and Accountability Act) and will only share your information with your selected provider and pharmacy.

Can a provider prescribe medication as part of an MDLIVE visit?

Yes, if the MDLIVE provider believes medication is warranted, he or she can write a prescription for non-narcotic medications (i.e. no controlled substances), which can be sent directly to the pharmacy of your choice.* As soon your consultation is over, your prescription will be sent electronically to one of over 65,000 pharmacies to choose from. If for any reason your pharmacy is unable to receive e-prescriptions, a traditional prescription is generated for our providers to sign and fax. All prescriptions are fully compliant and include all required information.

* Please note: Some state laws require that a doctor can only prescribe medication in certain situations and subject to certain limitations.

* MDLIVE physicians may not treat any children with urinary symptoms.

* Parents/guardian will be required to complete a different medical history disclosure form for children under the age of 36-months prior to making an appointment with an MDLIVE physician. Children under 36 months who present with fever must be referred to their pediatrician (medical home), child-friendly urgent care center or emergency department for clinical evaluation and care.

Who are the MDLIVE providers?

All MDLIVE providers are U.S. Board Certified and able to treat a wide range of patients and conditions.

Following each consultation, our members are given a survey to evaluate their provider and appointment.

The results are analyzed and reviewed for quality assurance and used as part of our continuous improvement process. Selected provider consultations are also reviewed by our internal medical board.

Can MDLIVE be accessed on mobile devices?

Yes, MDLIVE can be accessed on most mobile devices with an Internet connection. Our MDLIVE Mobile App is available for download in the iTunes Store and the Google Play Store.

Where is MDLIVE available?

MDLIVE is available anywhere in the United States**. Our network of Board Certified providers will be provided to you based on the state you are located. We make sure that each provider is fully licensed to practice medicine in your state.

** In Arkansas and Idaho; an initial visit must be completed via video. After an initial visit, subsequent consultations may be completed via phone.

When is MDLIVE available?

MDLIVE is available 24 hours a day, 7 days a week, and 365 days a year, even on holidays. Use MDLIVE anytime you have a non-emergency medical condition, are unable to see your primary care provider, or when you simply prefer a convenient, cost effective alternative to the emergency room, urgent care center, or clinic.

How do I sign up for MDLIVE and activate my MDLIVE account?

You can easily sign up and activate your account by using one the following methods:

- Go online and visit: mdlive.com/ect

- Call our toll free number: (888) 632-2738

- Download our Mobile App, available on the iTunes store and Google Play.

What Do Commuter Benefits Cover?

There are many options available to help you save while going to and from work every day. These include:

- Mass Transit and Vanpooling. You can use your benefits plan dollars for subway, bus, train and ferry expenses. Just swipe your debit card at one of over 10,000 terminal locations to pay for your transit passes. Or, use your benefits debit card to use pre-tax dollars on UberPOOL and Lyft Shared (formerly called Lyft Line) expenses tied to vanpooling in select cities.

- Parking. Save money when you park at or near your regular place of employment. You can also reserve or pre-pay for parking spots in select cities by adding your Discovery Benefits debit card as a form of payment in the SpotHero app. Go to spothero.com/cities for a list of SpotHero-friendly cities.

What is the Employee Assistance Program (EAP)?

The Health Advocate EAP+Work/Life Program is brought to you to provide support with personal, family, and work issues to help you achieve a healthy work/life balance. Health Advocate provides one on one, 24/7 support. You have confidential access to a Licensed Professional Counselor for short-term counseling for any stressful issue any time you need it. Our other experts, including work/life specialists, legal and financial consultants, and other professionals, will help you get the information you need to get back on track. Call 866.799.2728 when you have a stressful concern and need help. You will then be assigned to a Licensed Professional Counselor who will provide dedicated support. Health Advocate can help you with almost any kind of personal problem, like:

- Stress, Anxiety, or Depression

- Relationship and Parenting Issues

- Anger, Grief, and Loss

- Substance Abuse issues

- Financial and legal concerns

How do I get my maintenance prescriptions set up through mail order?

Save on medications you take regularly (such as high blood pressure or diabetes medicine) when you have them delivered by mail, in 90-day supplies, from CVS Caremark Mail Service Pharmacy. It’s an easy way to make sure you have the medication you need, when you need it, with one less thing to worry about.

There are two easy ways to get started:

Online – Visit Caremark.com/mailservice

– OR –

By phone – Call the number on your member ID card for live help getting set up.

Be sure to have a prescription bottle in hand, all the information needed to get started is on the label.

One 90-day supply typically costs less than three 30-day supplies, so you can be sure you’re paying a lower price. CVS Caremark delivers by mail, anywhere you choose, with no-cost shipping.

Mail delivery means no more monthly trips to the pharmacy, and with automatic refills, you won’t need to keep track of refill schedules either. CVS Caremark will alert you 10 days before a refill in case you need to change the delivery date or location.

Every order is filled by a licensed pharmacist, then quality checked before shipping. Our discreet packages are tamper-proof, weatherproof and temperature controlled. Plus, CVS Caremark will send status alerts by email, phone or text – so there’s nothing to worry about. Download the CVS Caremark mobile app to manage mail orders anytime, anywhere!

What is telehealth?

Telehealth uses digital information and communication technologies to allow members to access healthcare away from the doctor’s office. The Trust medical plan partners with MDLIVE to bring participants remote access to quality healthcare through MDLIVE’s board-certified doctors. They are professionally trained to use virtual technology to treat many non-emergency conditions. MDLIVE’s doctors are board-certified and have an average of 15 years of experience. Go to https://members.mdlive.com/ect to register now!

I was billed by my provider for expenses I do not think I should have been billed for. Who should I contact for help with this?

Health Advocate’s experts will take on virtually any healthcare or administrative issue so you get to the right care at the right time at no cost to you. If you’ve received a bill or have a claim that you need help with, call Health Advocate at 866.799.2728 or email answers@healthadvocate.com to have your own personal health advocate tackle the issue for you! If authorizations are required to resolve your inquiry, the Advocate assigned to your case will send you any required authorizations forms electronically.

How do I read my medical EOB (Explanation of Benefits)?

Since an EOB isn’t a bill, what you pay is for your information only. If you owe the doctor, or hospital, they’ll send you an invoice. Comparing the EOB and the invoice is a good way to make sure you’re getting billed correctly by the doctor or hospital.

Not all claims generate an EOB. For example, you won’t get an EOB for a prescription. EOBs show you the costs associated with the services you received, including:

- Claim Details, each service or procedure from each provider is explained

- What the provider charged

- What the allowed charges are (this is the contracted amount in which an in-network PPO provider agrees to accept as payment)

- Any non-allowed charges (discount or amount billed over the contracted amount for this service)

- What the Plan pays

- Total covered

- What you pay (summary of Deductibles, copays, and coinsurance)

How do I change my address for my benefits through the Trust?

Contact human resources or your benefits manager to have your address updated for all of the Trust plans you are enrolled in.

What is pre-authorization or pre-certification?

Pre-authorization or pre-certification is a process completed by Conifer Health Solutions, the Trust’s Utilization Management Vendor. Certain services covered by the Plan require this process (like Hospitalizations, Continued stays at an Inpatient Facility, and some outpatient services).

If your Physician recommends that you or a covered family member be hospitalized, you must contact the Utilization Management Vendor for assistance with the certification process. Hospitalizations out of the country or when this Plan is the secondary payer do not require pre-certification. All other hospitalizations require pre-certification prior to an elective or planned hospitalization or the next business day after an urgent or emergency admission. To obtain pre-certification for an admission, call Conifer Value-Based Care at 877-687-9527.

When you call, have your Medical ID number, Employer name, patient name, home phone number, physician name and phone number ready.

Notification may be initiated by you, a family member, your Physician, or representative from the hospital. The Utilization Management Vendor will review your Physician’s recommendations based on the medical information supplied and accepted standards and criteria for hospital admission. In most cases, the Utilization Management Vendor will notify you, your doctor, and the hospital of your certification approval within 24 hours. (For hospitalizations, the hospital will be advised of the number of approved days when Conifer provides certification approval).

Who is Health Advocate, and how can they help me?

Navigating the healthcare system, improving your health and addressing personal problems can be challenging. Health Advocate’s experts will take on virtually any healthcare or administrative issue so you get to the right care at the right time. Health Advocate will also provide personalized coaching to help you reach your health goals and confidential counseling to help you work through personal issues. All at no cost to you. Click here to watch a short video to find out more about Health Advocate’s service.

Who is Conifer Health Solutions?

Conifer Health is a certified health solutions company and a national leader in personal health management and healthcare technology. With 30 years in the healthcare industry and on-the-ground experience in 135 markets nationwide, Conifer knows the ins and outs of local health systems, physician groups, employers and unions. Conifer helps members navigate the healthcare system and provide the tools for them to adopt healthy behaviors through collaboration and education. The Utilization Management provisions of the Trust’s Plan are administered by Conifer, our Utilization Management Vendor. The staff at Conifer are Physicians and Registered Nurses who monitor the use of your health care benefits to ensure that you and your family:

-

a. Receive the best medical care possible in the most appropriate health care setting;

b. Avoid unnecessary surgery and excess hospital days; and

c. Receive answers to questions you have regarding medical care.

Components of the Utilization Management program include:

-

a. Pre-certification of all hospital admissions,

b. Continued Stay Review of all hospitalizations;

c. Pre-certification of all Outpatient surgeries and the following: Residential Treatment Facility for Mental Health and Substance Abuse (considered inpatient); Birthing Centers; Clinical Trial Patient Cost Coverage; Intensive Outpatient Services for Mental Health and Substance Abuse, Durable Medical Equipment over $1,500 per Calendar Year; Home Health Care; Hospice Care; Skilled Nursing Facility, and Surgical treatment of morbid obesity;

d. Case management of potentially catastrophic cases;

e. Disease Management.

Pre-certification, continued stay review, and outpatient pre-notification decisions are based on the medical policy guidelines of the Utilization Management Vendor. Otherwise, all Medical Necessity reviews will be performed by the Claims Administrator utilizing CareFirst BlueCross BlueShield and other applicable medical policies.

How do I find a doctor, hospital, or urgent care center near me?

It’s easy to find the doctors you need at www.cfablue.com.

Select the Members tab on the top right-hand side of the screen.

Select Search Providers under Find a Doctor on the left-hand side of the screen.

Select Find a Doctor under Medical.

Enter your Location then enter ECT as the plan prefix.

Click on the Continue button.

Select one of the search options: Doctors by name, Doctors by specialty, Places by name, or Places by Type.

Populate the search field(s) with your search criteria. Click the magnifying glass icon, or hit the enter key to review a directory based on your search criteria.

How do I request a new dental ID card?

Call Delta Dental Benefit Services at 800.237.6060 to request a new dental ID card. In a rush? To print your own card, log in to the Delta Dental of Virginia subscriber portal at www.deltadentalva.com. Click on the Print ID Card hyperlink on the left side menu.

How do I request a new medical ID card?

Log in to the CFA member portal at www.cfablue.com. Click the Request ID Cards tile. Follow the instructions and click Submit my Request. You’ll receive a replacement member ID card in 7-10 business days. Need one sooner? On the CFABlue home page, click on the Digital ID Card tile. Follow the instructions to view and print your ID card.

If you are unable to log into the CFA member portal, please contact CFA member services at 877.889.2478. Once your identity is verified, a member services representative will be able to order a new card for you.

Who can help me resolve a claim issue?

Dealing with insurance companies can be hard! Health Advocate can do that for you. Call 866.799.2728, email answers@healthadvocate.com, log into our website from your computer, or download our app to your device to have a dedicated advocate untangle medical bills and resolve claim and billing issues for you. Have your insurance ID card, bill or Explanation of Benefits (EOB), and the provider’s name and office contact information to get the process started with Health Advocate.